IMI BIGDataAIHUB Case Competition - Introduction to the Case and Data

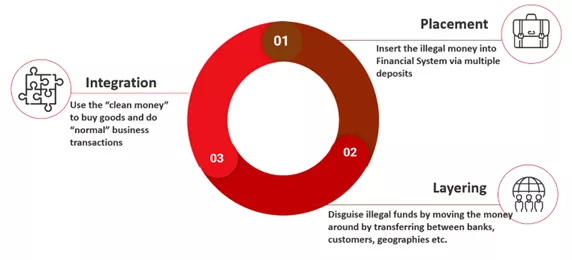

The 2022-2023 IMI BIGDataAIHUB’s Case Competition details are released! Sponsored by the BIGDataAIHUB in collaboration with Scotiabank, STEM Fellowship and ICUBE. Scotiabank hosted the first technical workshop on November 30, the presentation can be found here. This year, participants are tasked with using customer data to identify money laundering and detect financial crimes. Money laundering is the act of “turning the proceeds of crime into cash or property that looks legitimate and can be used without suspicion.” There are three stages of money laundering outlined below.

What is Money Laundering?

Stage 1: Placement — inserting illegal funds into a financial system through multiple deposits

Stage 2: Layering — disguising illegal funds by moving the money around (i.e. transferring between banks, customers, or geographies)

Stage 3: Integration — using the “clean” money to buy goods and do “normal” business transactions

Preventing Financial Crimes

How can we prevent financial crimes? First, by knowing your customer. Start by collecting customer information at onboarding (name, address, occupation, source of funds and wealth, account activity, product usage, etc.). Next, systematically screen new clients’ names against watchlists. Then create a client risk rating as low, medium, or high. The second strategy to prevent financial crime is through ongoing monitoring. Ensure to keep customer data up-to-date. Continue to systematically monitor transactions–particularly volume and frequency. Additionally, monitor client names and payment data against the most current Watchlist.

Case Competition Tasks

Case competition participants are asked to produce three deliverables:

- Name Screening: Find as many bad actors as possible using public data sources to match customer names with the watchlist.

- Customer Risk Ratings: Using customer and transactional data create models that classify customers into Low, Medium or High risk and predict bad actors using results from the first as a dependent variable.

- Improve Model with Graph Data: Enhance the second ask by using customer connections to either: extract new features, fit graph models directly, or visualize interesting networks.

Advice to Participants

The workshop closed with advice to help case competition participants succeed.

Seven tips for success:

- Get access and familiarize yourself with the data provided

- Do an extensive exploratory data analysis to understand correlations and patterns

- Research machine learning/ statistical techniques used to solve similar problems – leverage the UofT library, seek insights from other domains outside of Finance

- Define a robust validation methodology to assess your model’s performance

- Select relevant evaluation metrics for each problem

- Start with simple models, learn from their outputs, and leverage insights to understand patterns in the data, draw sensible conclusions, and find ideas for more complex models

- Plan in advance: create deadlines for your presentation and video submission, make weekly goals, and split tasks among team members aligned with their strengths