Fighting Crime with Big Data Conference Summary

The Fighting Crime with Big Data Conference took place on March 25th, 2023. The conference began with introductions from Kevin Yousie and Irene Wiecek, conference Co-Chairs and professors at the University of Toronto, as well as Stuart Davis the EVP of Financial Crime Risk Management at Scotiabank. Introductory comments included presenting the urgency of identifying money launders and the underlying crimes that create the need for money laundering –including human trafficking. The speed at which bad actors can move is incredible –to combat this we need to leverage new technologies. For many years the challenge has been the bottom-up approach; in the future, we can take a top-down approach with big data.

The conference proceeded with three guest speakers, a panel discussion, and concluded with the announcement of the BIGDataAIHUB Competition’s Winning Teams.

Keynote Speaker 1: Ian Mitchell

A Life (and Career) Worth Living: Your career can be a part of making the world better and bringing you success

Ian Mitchell presented the first keynote; he has 25 years of fraud-fighting experience, and his current work seeks to unite financial industries to fight human crime and money laundering practices. He is the Founder and Board Chair at The Knoble and a co-founder of Mission Omega. Ian began his talk in a unique way—by singing an original song called The Old Dirt Road. Beyond Ian’s tenured career, he is also a passionate musician. This song describes his journey of reigniting his passion after experiencing burnout, which will be described more below.

Making the World Better with Work

About five years ago, while traveling, Ian met Matt Freidman, an advocate against modern slavery. He enlightened Ian about the impact banks can have in fighting human trafficking. He provided Ian with the red flags of human trafficking and as he dug into the data he realized that in his 20 years fighting fraudulent transactions, he had missed the human beings being impacted behind the crimes. He wrote and performed the song Old Dirt Road to represent his journey of re-igniting his passion in an industry that had sucked him dry and completely burnt him out.

With this new-found passion, Ian founded The Knoble. Their mission is awakening, equipping, and deploying financial services professionals to protect the vulnerable including victims of human trafficking, child exploitation, scams, and elder abuse.

Human Crime

There are four primary areas of human crime, namely Human trafficking, child exploitation, scams (link to other evil practices), and elder abuse. Human trafficking is also known as modern slavery, which is comprised of sex trafficking making up 25% of instances, and forced labour making up 75%.

The Solution

The solution is You. We need innovative minds in the field.

Get Involved: Expand your program.

Be part of prevention, detection, and response.

Mission Omega

Mission Omega is a for-profit fraud fighter. We provide fraud consulting, and 25% of our employees are survivors. We strive to help banks stop fraud in a material way.

Ian concluded the seminar in the same way it started, with a song.

“Live every day as if it were my last. Going to make every second last.

Love, joy, and happiness.”

Keynote Speaker 2: Amir Tavafi

Amir Tavafi is the Director and Product Lead of Fraud Detection and Management at Verafin Inc.

Comprehensive Nasdaq Anti-Financial Crime (AFC) Suite

The AFC Suite includes fraud detection, anti-money laundering, and surveillance. Verfain Inc. specializes in fraud detection and anti-money laundering. Verafin’s purpose is to protect the world from financial crime. The three major financial crimes include:

- Fraud: scams, elder abuse, payments fraud

- Money laundering: terrorist financing, drug trafficking, human trafficking, crime rings

- Market abuse: insider trading, market manipulation

Collaborative Frameworks Overview

There are five primary collaborative frameworks leveraged to fight financial crimes.

- Managed Analytics: analytical models based on the shared understanding of industry typologies for financial crime risks.

- Messaging Services: services that enable participants to securely share information related to financial crime where a regulatory safe harbor exists.

- Consortium Analytics: Models that analyze data from across a network of institutions to identify financial crime risk.

- Adverse Incident: A data set of known risky events from across the industry.

- Collaborative Investigators: Tools that allow participants from across the industry to work together on a joint investigation through the sharing of data.

Information Sharing by the Numbers

Keynote Speaker 3: Matthew McGuire

What Smaller Entities Can Do to Counter Money Laundering and Human Trafficking.

Matthew McGuire is the Principal and Practice Leader at the AML Shop. He is a forensic accountant and an anti-money laundering expert. His keynote talk described how small entities can also help in the fight against the financial crime of money laundering and the associated crime of human trafficking. He first described what organizations are included in the small entities’ definition. Next, he described five roles of a small reporting entity. Finally, he concluded with five sources of data and intelligence small entities can leverage.

Who are these “Small Entities”?

- Accountants involved in qualifying activities

- Lawyers and British Columbia Notaries

- Casinos

- Smaller Life Insurance Companies, Brokers, and Agents

- Securities Dealers

- Smaller Banks, Trust, and Loan

- Credit Unions and Caisses Populaires

- Money Services Businesses

- Real Estate Brokers, Developers and Agents

- Trust and Company Services Providers

- Dealers in Precious Metals and Stones

- Other Dealers in high-value goods (sooner or later)

- Payment services providers

- Payday loans and similar

- Armoured car companies

- Mortgage lenders, brokers, and servicing

The Roles of a Small Reporting Entity

- Deter money launderers from trying

- Creating a hostile environment if they do

- Maintaining a solid audit trail for any eventual investigation

- Identifying and reporting suspicious transactions to FINTRAC

- Managing other risks and relationships (i.e. duty of care)

Data and Intelligence Sources for Small Entities

- Their own sources (limited and no data/model governance and validation protections)

- Guidance

- Open sources and data projects (Open corporates, Open Government)

- Pay for use databases

- Peers and industry associations (the ideal)

Panel Discussion

Moderator: Alia Lalani, Panelists: Ashley F. Tingley, Nathalie Martineau, Carrie Chai, and Nunzio Tramontozzi

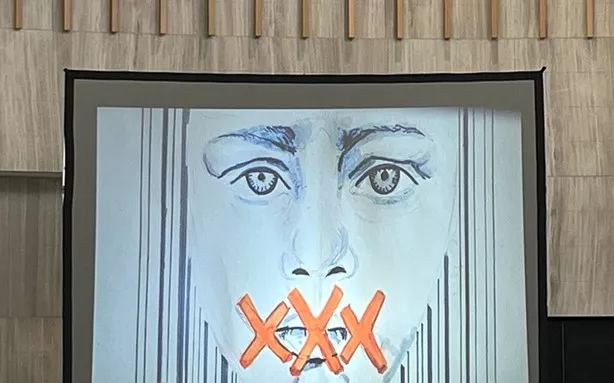

The Fight Against Human Trafficking

The panel discussion began with a powerful quote from Former U.S. President Barack Obama, “And today, I want to discuss an issue that relates to each of these challenges. It ought to concern every person, because it is a debasement of our common humanity. It ought to concern every community, because it tears at our social fabric. It ought to concern every business, because it distorts markets. It ought to concern every nation, because it endangers public health and fuels violence and organized crime. I’m talking about the injustice, the outrage, of human trafficking, which must be called by its true name – modern slavery.”

What is Human Trafficking?

Ashley F. Tingley introduced the topic with this definition: criminal activity that involves the exploitation of a person for another person’s financial gain. This year it has been estimated that 50 million people are involved in human trafficking. Sex trafficking is a form of human trafficking defined as forced coercive engagement of sex for something of value (i.e., food, money, shelter). Seventy-one percent of reported cases were identified as sex trafficking, followed by labour trafficking cases. Migrant workers are underrepresented and are experiencing language and cultural barriers.

Risk Factors

Some risk factors for human trafficking include:

- Language barriers

- 2LGBTQiA

- Precarious immigration status

- Living in poverty and/or homeless

- Low-self esteem

- Foreign national

- Mental health challenges

- Access to social media

- Past abuse

Financial Coercion and Human Trafficking

Someone being trafficked may:

- Be threatened, forced, or tricked into renting cars, paying for hotels, gas, food, rent, etc.

- Be forced to take out personal loans, student loans, open lines of credit, or apply for certain social media benefits which are then turned over to the trafficker

Nunzio Tramontozzi shared his unique perspective on human trafficking, given his background as a police officer and present role as Special Investigation Unit Projects, FCRM at Scotiabank. His experience has given him a first-hand view of human trafficking in Canada. Both Nunzio Tramontozzi and Nathalie Martineau (Regional Director at FINTRAC) emphasized the importance of FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) for accessing intelligence from the financial side of human trafficking.

See this article for more information about human trafficking in Canada: https://www.cbc.ca/news2/interactives/sh/Z9xYpkTjVq/human-trafficking-canadian-girls/

Carrie Chai discussed the application of AI and ML in anti-money laundering (AML) and its connection to human trafficking. She described how traditional modeling cannot solve the problem of identifying cases of human trafficking. Therefore AL/ML is needed to keep up with the new techniques and strategies that human traffickers are using. Carrie described that there is no single red flag to identify human trafficking. There are several models they use, such as:

- AML Customer Lifecycle with AI Opportunities Overlaid

- Network Analysis to Model Sophisticated Interconnections

These models help to visualize interactions to help investigators, as well as provide scores to identify individuals with a higher likelihood of involvement in human trafficking activity.

The United Nations issued a report on the Trafficking in Persons. This sobering report describes how this crime is becoming harder to detect, and more prevalent given the increased amount of time children are spending online, increased isolation, and increased time children are spending at home.

With this in mind, we must fight against human trafficking and associated crimes with increased urgency. Each one of us has a part to play.

Closing Remarks: Gail Towne

Announcement of the BIGDataAIHUB Competition Winning Teams

Gail Towne is the Vice President and Global Head of Financial Crime Risk Management Models and Analytics at Scotiabank. She presented the first, second, and third-place winners of the 2022-2023 BIGDataAIHUB Competition. Out of 51 teams, three teams were selected, namely:

- First Place – Team 35

- Second Place – Team 25

- Third Place – Team 39

Congratulations to the winners! A big thank you to everyone who made the case competition and the Fighting Crime with Big Data Conference a success!

Be on the lookout for our upcoming BIGDataAIHUB Seminar Series